Disambiguation

CBA vs SROI vs VFI

In the past week I’ve been invited by three different groups to give presentations on similarities and differences between Cost-Benefit Analysis (CBA), Social Return on Investment (SROI) and Value for Investment (VfI) and how to navigate decisions about which of these approaches to use. It’s great to see increasing awareness that there are multiple options for tackling value-for-money (VfM) questions and a desire to understand what each option offers.

Previously, I’ve written detailed analyses that compare these methods from different perspectives. I’ll share links to those articles at the end. The purpose of this article is to simplify the comparison, with a series of visual summaries to highlight key features of the three approaches.

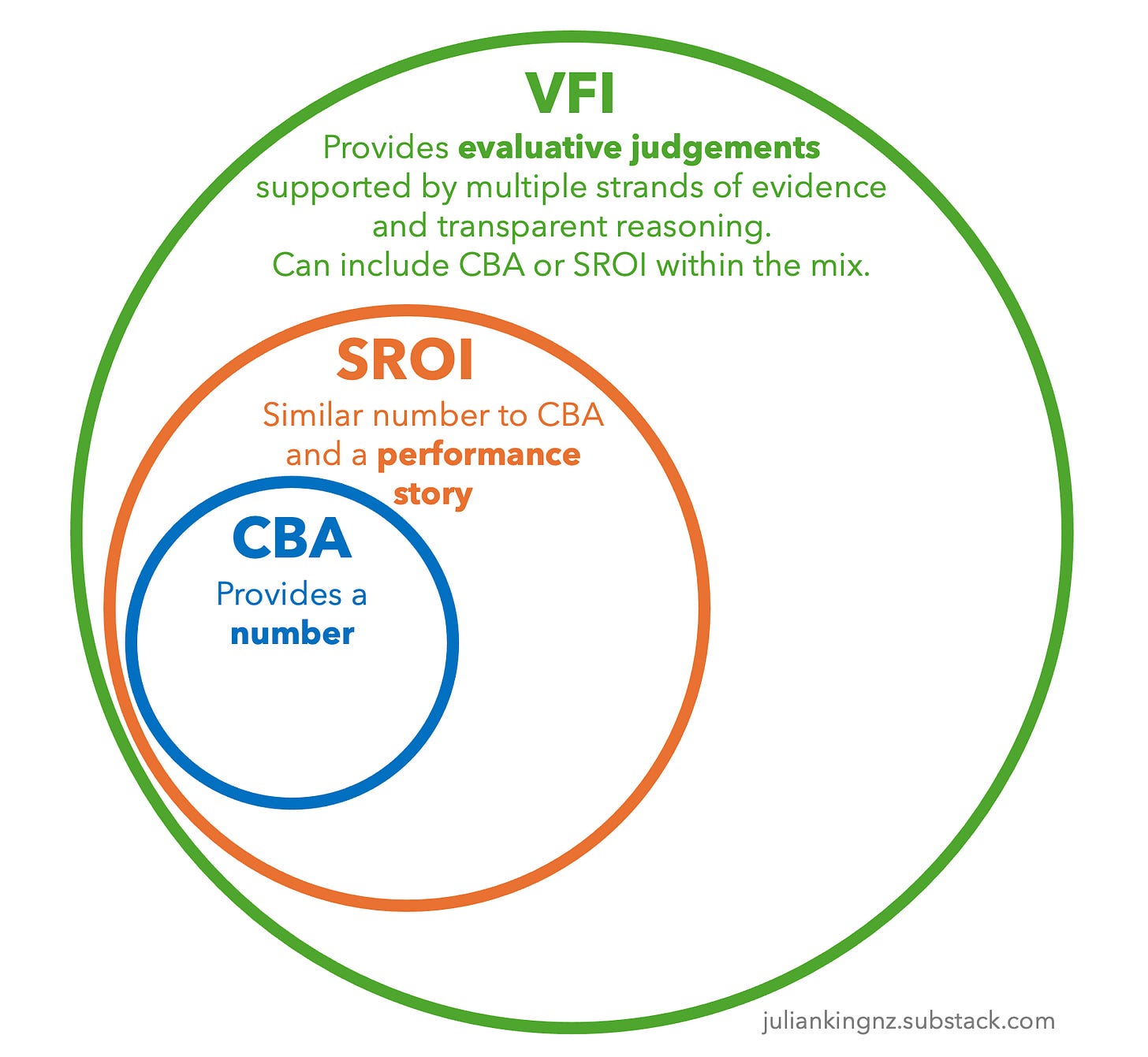

CBA, SROI and VfI emphasise different aspects of VfM when they present their conclusions

One of the ways to contrast the three approaches is by what their guidance says their conclusions should look like. Each emphasises a different kind of answer to a VfM question. The scope of the answer expands as you progress from CBA to SROI to VfI.

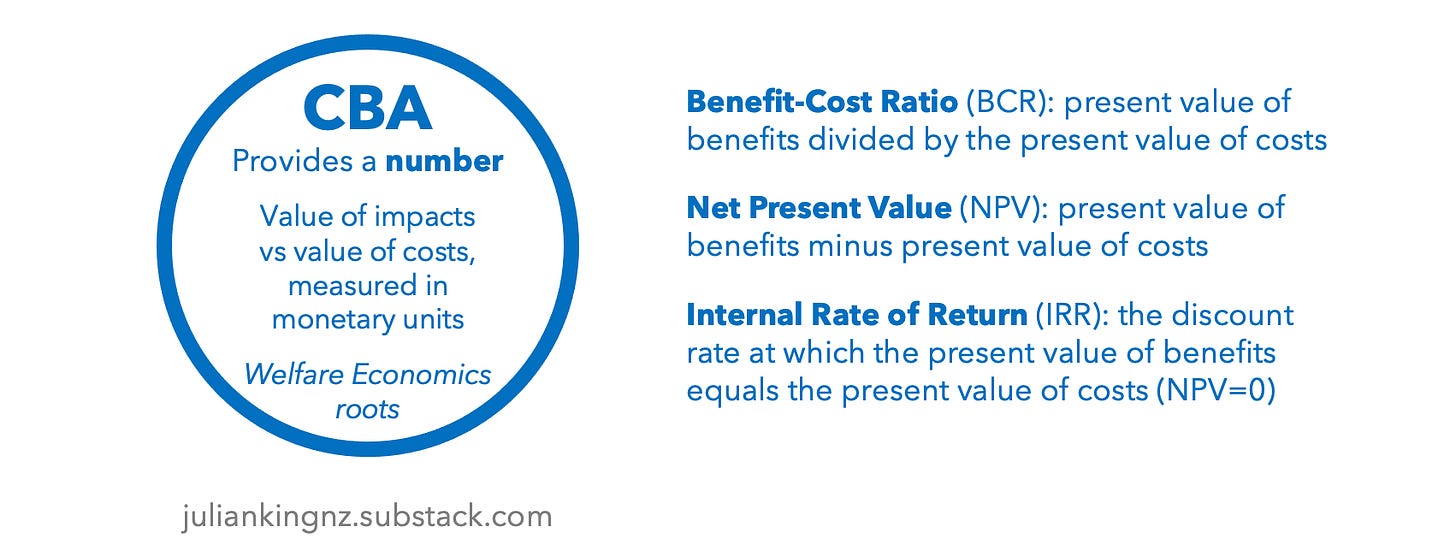

CBA expresses the value of a policy or program as a number. The report may also present a lot of descriptive analysis, but the number is the punchline. This number, usually a Net Present Value (NPV) or Benefit Cost Ratio (BCR), is an aggregation of monetary valuations of resources and impacts attributed to the investment. For example, an NPV of a particular intervention might indicate that its benefits exceed its costs by $5 million. A BCR of the same intervention might indicate that for every $1 of resources invested, $2 worth of benefits are created. The number is often uncertain, and may be presented as a range estimate (e.g., for every $1 of resources invested, $1.70 to $2.30 of benefits are created).

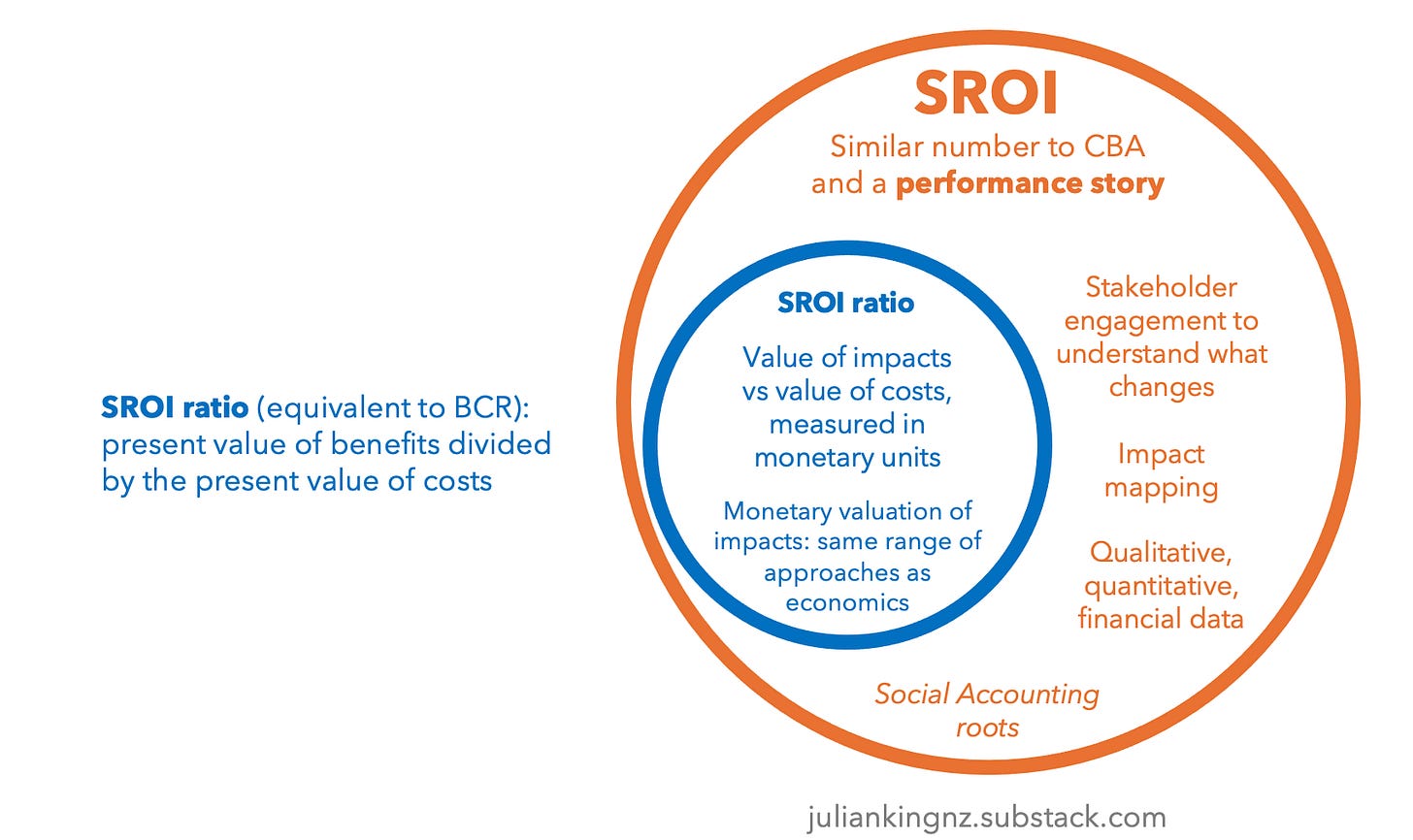

SROI provides the same kind of number as CBA, plus a performance story. The number, which in this context is often called the “SROI ratio”, is equivalent to a BCR and represents the present value of benefits divided by the present value of costs. The performance story often draws on qualitative, quantitative and financial evidence to provide a rich narrative explaining how the policy, program or organisation functions, what it achieves, and why it matters to stakeholders.

In practice, a good social CBA and a good SROI can be hard to tell apart. Analysts often use elements from both approaches - and indeed I think they should, leading me to argue here, “I don’t care what you call it, just do it well”. The difference I’m describing above is one of relative emphasis: when CBA guidance talks about presenting contextual information, it is primarily concerned with supporting transparency and replicability - e.g., explaining decisions about modelling, valuation, and interpretation of findings, whereas SROI guidance is more explicit about treating a performance narrative as an important component of the findings in its own right.1

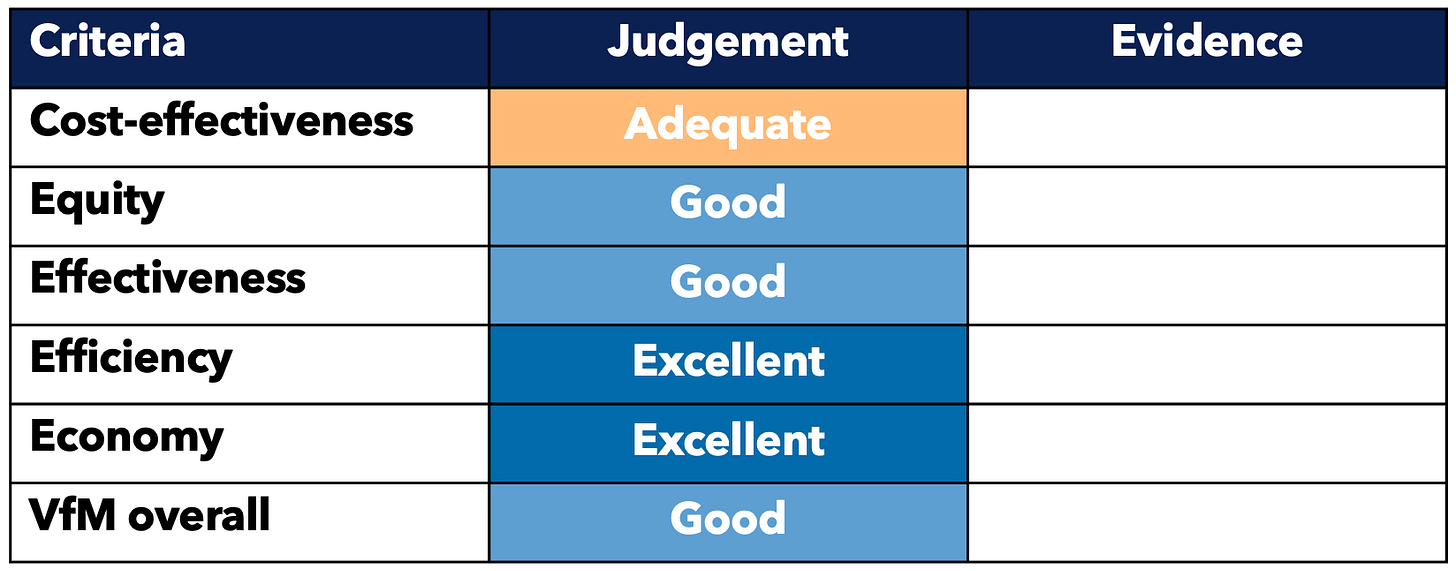

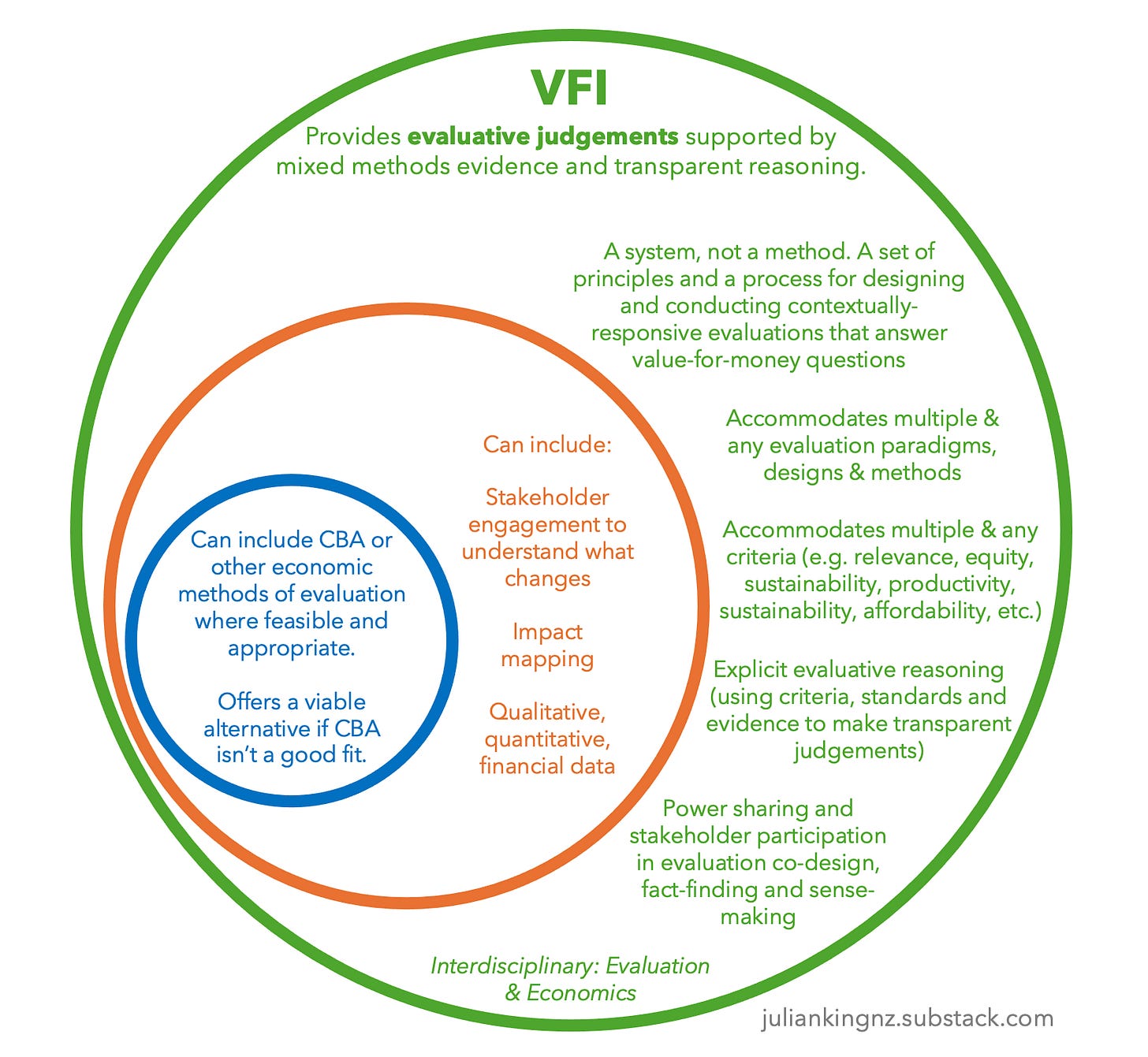

VfI provides transparent evaluative judgements, based on agreed criteria (aspects of value), standards (levels of value) and multiple strands of evidence. VfI can include CBA or SROI findings within the evidence mix, but it doesn’t have to. Here’s an example of what a set of evaluative judgements can look like (the specific criteria and standards are determined contextually so the ones shown are illustrative). In this example, we could use something like CBA or SROI to provide full or partial evidence for the cost-effectiveness criterion, and various other quantitative and qualitative methods to supply evidence to address other criteria.

This comparison only highlights how the headline findings differ: a number (CBA), a number and a performance story (SROI), and a set of evaluative judgements backed up by evidence and transparent reasoning (VfI). All three approaches provide much more than just headline findings, of course. I would expect to see breakdowns of evidence and discussion of findings in all three reports.

Furthermore, any CBA, SROI or VfI report should be transparent about design and methodological decisions, data sources, assumptions, procedures, sensitivity analysis, and limitations.

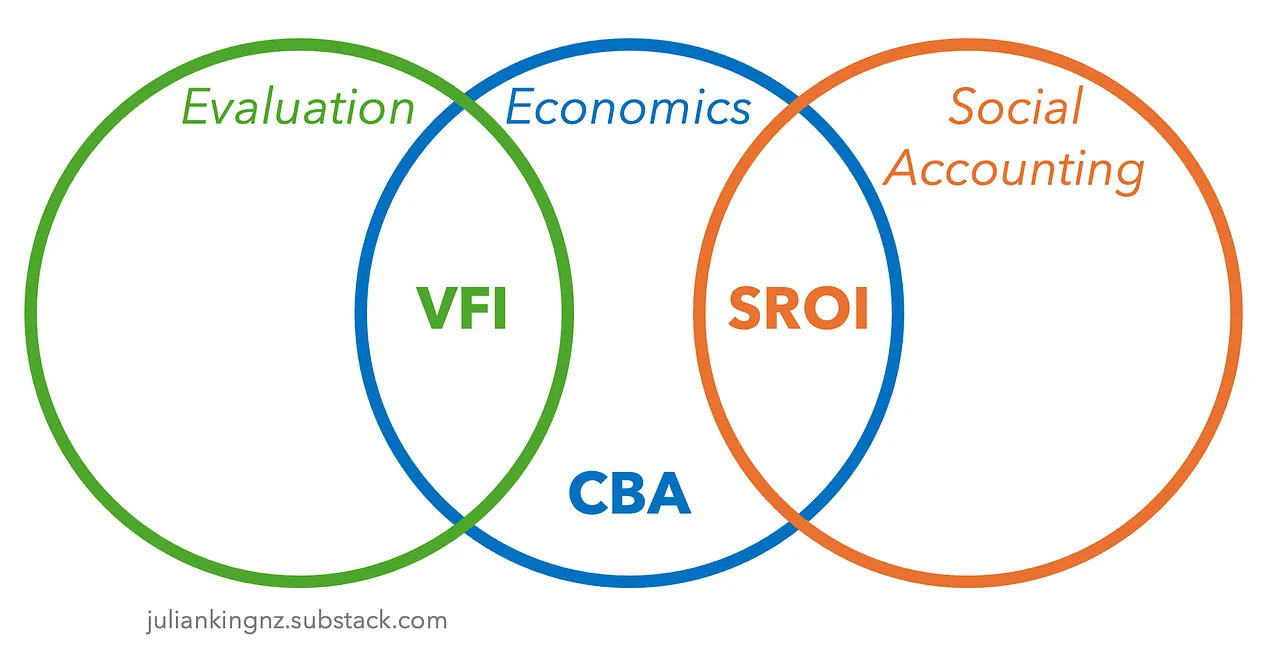

CBA, SROI and VfI have different theoretical foundations

CBA is built on principles from welfare economics, a branch of economics that studies how the allocation of resources affects the overall wellbeing of society.

SROI’s home turf is social accounting. However, the SROI Guide references the same suite of methods for placing monetary values on impacts as economists use. So in the diagram below I have plotted SROI at the intersection of social accounting and economics.

VfI integrates theory and practice from evaluation and economics. VfI is explicitly an inter-disciplinary approach. Moreover, VfI draws more from economics than just CBA. It also incorporates other economic methods of evaluation (such as cost-effectiveness and cost-utility analysis, where feasible and appropriate), and uses economic concepts such as opportunity cost, efficiency, productivity, and more.

The conduct of a specific VfI, SROI or CBA may draw on other disciplines to inform study designs and methods that fit different contexts. For example, an assessment of a population health program might draw on insights from epidemiology. However, this diagram captures the disciplinary roots from which each approach developed.

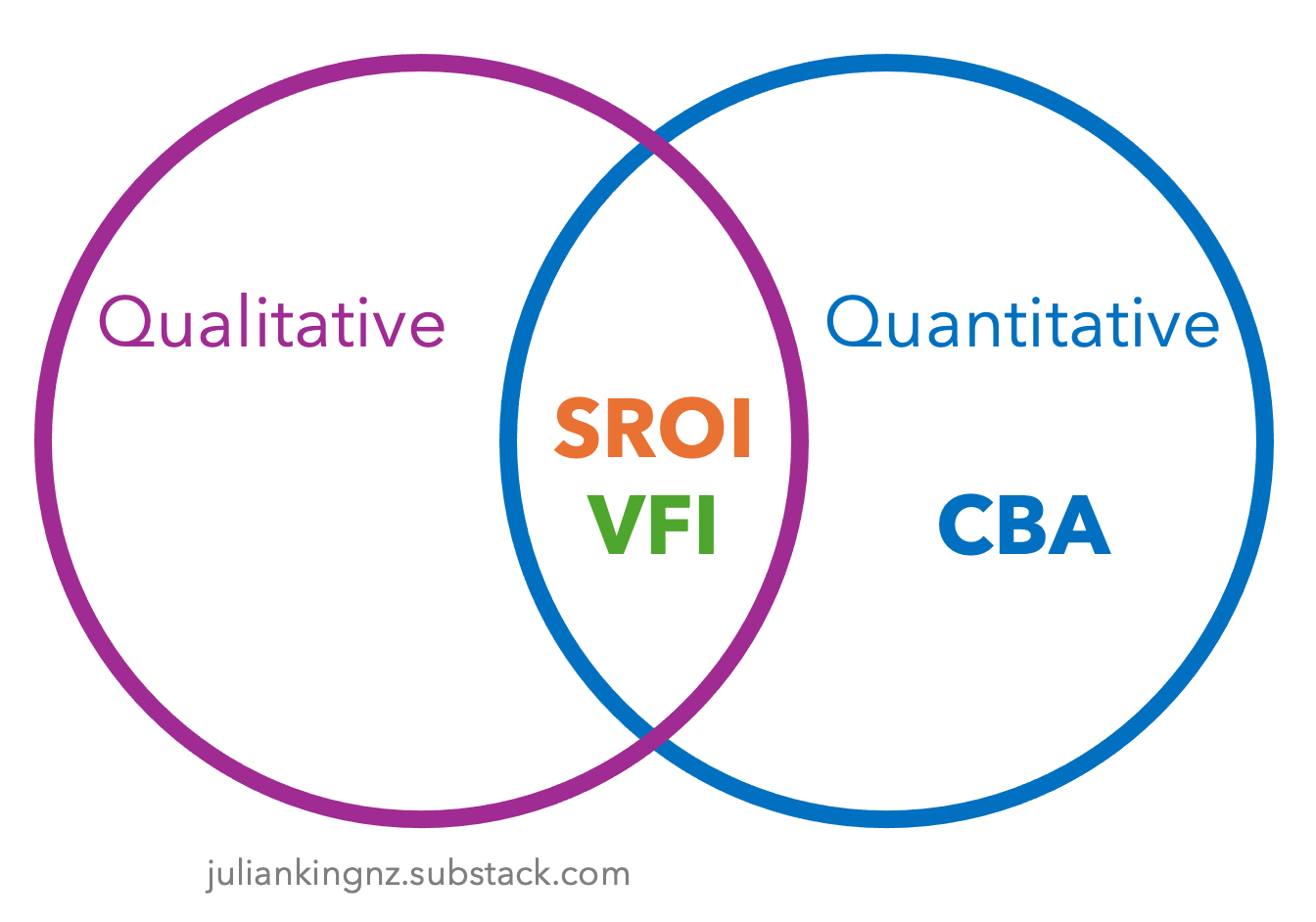

CBA, SROI and VfI vary in the scope of methods used

The scope of methods expands as you progress from CBA to SROI to VfI.

CBA is a quantitative method. That doesn’t mean qualitative considerations aren’t taken into account in its design, nor that qualitative considerations aren’t acknowledged in the report. It’s just that the core of the analysis is a spreadsheet with numbers in it, supported by quantitative approaches to valuing and causal inference. And the output of the analysis is a number, like NPV and/or BCR.

SROI uses qualitative and quantitative methods. It includes the same kind of spreadsheet analysis as CBA. However, it also involves engagement with stakeholders. SROI guidance suggests methods such as interviews, focus groups, surveys, documents review and impact mapping to understand what changes and the value that stakeholders place on those changes. It emphasises that the number alone isn’t the story, and balances qualitative, quantitative and monetary aspects of describing value.

VfI is a mixed methods approach. It doesn’t prescribe the mix of methods; rather it can accommodate any mix. VfI contributes a framework for selecting and using a situationally-informed mix of methods and tools to answer VfM questions. The aim of combining different evidence sources is to provide a deeper understanding of the policy, program or organisation than we might get through the use of a single method.

Myth-busting: Perceived differences that aren’t really differences

It is sometimes perceived that SROI incorporates a broader range of benefits than CBA. Not true. The nature of benefits that are included (e.g., social, environmental, economic, financial) depends not on which method is used but how they are used. Deciding which benefits are in and out of scope is an important aspect of study design under either method, and either method can accommodate the same scope of benefits and costs. When deciding which benefits and costs to include in a CBA or SROI, there can be trade-offs, e.g., between comprehensiveness and reliability. Not everything of value has a precise monetary valuation. Determining what values are relevant, material, and feasible to estimate to a reasonable degree of accuracy, precision and credibility is an important judgement call whichever method is used.

It is sometimes perceived that SROI is “overly-optimistic CBA”. In my view, a good CBA and a good SROI should be conducted to the same standards of rigour and transparency, and should reach equivalent conclusions. If a CBA and SROI reach different conclusions about the same investment, it would reflect differences in how well the methods were applied. SROI has introduced systematic analysis of costs and benefits to a wider audience than those trained in economic evaluation. This is positive, but also brings risks of variability in the way it is practiced. A recent article on SROI highlighted some deficiencies in the way some SROIs have been carried out, including problems with approaches taken to causal attribution and valuing impacts. These issues are not unique to SROI (all methods are vulnerable to sub-standard use) and would be addressed if analysts follow established standards of scientific research and economic evaluation.

It is sometimes perceived that CBA is “more objective” than VfI. This is false. Both CBA and VfI (like all forms of evaluation) involve dealing with facts which are value-laden, and values that are also facts. Both approaches necessitate various kinds of judgements. The outcomes of a CBA are influenced by the analyst's decisions regarding the relevant scope of benefits and costs, the perspective of the analysis, the time frame over which benefits and costs are significant, the discount rate, the methods used for monetary valuation, and the interpretation and presentation of the results. These judgements (and more) should all be made transparent in a CBA report. In a VfI evaluation, evaluative reasoning based on explicit criteria and standards offers a transparent and systematic approach for synthesising evidence. It minimises individual bias by clearly and collaboratively defining shared values and making the evaluation process open to scrutiny and challenge. Ultimately, both CBA and VfI offer valid approaches to combining robust evidence with human judgement.

In summary

Cost-benefit analysis is primarily a quantitative method (albeit supported by qualitative considerations in study design and reporting) that summarises the value of a policy or program based on the present value of impacts compared with the present value of costs, measured in monetary units.

Social Return on Investment provides a similar number to CBA plus a performance story. SROI is a mixed methods approach because it also involves stakeholder engagement, impact mapping, and combining qualitative, quantitative and financial data.

The distinction between CBA and SROI is starker in theory than in practice. Ultimately, if CBA or SROI are used to their full potential, I believe they should look the same and reach the same conclusions, drawing on complementary strengths of both traditions.

Value for Investment is a system, not a method; it provides a set of principles and a process to help guide contextually-responsive evaluations and select an appropriate mix of methods. Those methods can include CBA or SROI, among others. VfI isn’t a rival to CBA or SROI, but it can help you decide when and how to use them.

VfI is intended for situations when a broader perspective is needed than CBA or SROI alone provide, involving multiple criteria and evidence sources. Explicit evaluative reasoning (using criteria, standards and evidence to make transparent judgements) is the backbone of a VfI evaluation.

While SROI includes stakeholder engagement aimed at understanding what changes, VfI goes further, sharing power with stakeholders and involving them in evaluation co-design, fact-finding and sense-making.

Bottom line

All three approaches can help to answer VfM questions and inform good resource allocation decisions. Whichever method you select, they all require reliable evidence, sound reasoning, transparent reporting, and a healthy dose of evaluative thinking to ensure the conclusions reached are warranted.

To find out more

Thanks for reading!

Where’s this? The first person to correctly identify the location of this photo in the comments below wins a free 12-month subscription to the full Evaluation and Value for Investment archive.

I updated this paragraph to reflect reader feedback. I’d like to acknowledge Sarah Hogan for commenting that in practice, analysts may use elements from multiple approaches, making the distinctions less clear than they are in theory. Aaron Schiff commented that the elements that make up a CBA’s headline number can themselves be revealing - showing where benefits and costs arise, how they are distributed across different population groups, and how results shift under alternative assumptions through sensitivity analysis. Qualitative evidence informs those assumptions too. At its best, CBA is more than just a spreadsheet - it’s a framework for communicating value and trade-offs.

Very informative article. Thank you. I'm guessing that photo is the Sydney Opera House?