VfI quick-start guide

A practical resource for a rapid start in designing a Value for Investment framework

You know that feeling when you buy a new gadget and it comes with a massive instruction book (typically in 5-point font, with complicated diagrams)?

And that sense of relief when you find there’s also a quick-start guide (QSG)? Like a one-pager with a simple picture and some easy words like, “plug in, switch on, follow the on-screen instructions”?

The QSG is like a big friendly arrow on a map, saying ➡️ Start Here! It doesn’t replace the full instruction manual, but it serves the very important purpose of just getting you started.

I don’t know about you, but if I have to read the full manual before I can use the product (app, device, method, etc), I may set it aside for later, with the risk I might not return. The QSG mitigates that risk. It reduces my cognitive load and helps me feel less daunted about learning how to use a new product. It makes the process feel accessible and achievable. This makes it more likely that I’ll get started, and that I’ll feel positive about using the product.

I want you to feel that way about the Value for Investment approach! So I decided to develop a QSG.

I found this handy primer on quick start guides. I realised that my 4 principles and 8 steps are a quick reference guide. This is also important, but it’s not the same as a QSG. We need both.

Quick start guide

The following QSG is designed to help you get started in a VfI evaluation. It’s a ‘beta version’ - intended for user testing and feedback. So please test it and give me feedback so I can keep refining it.

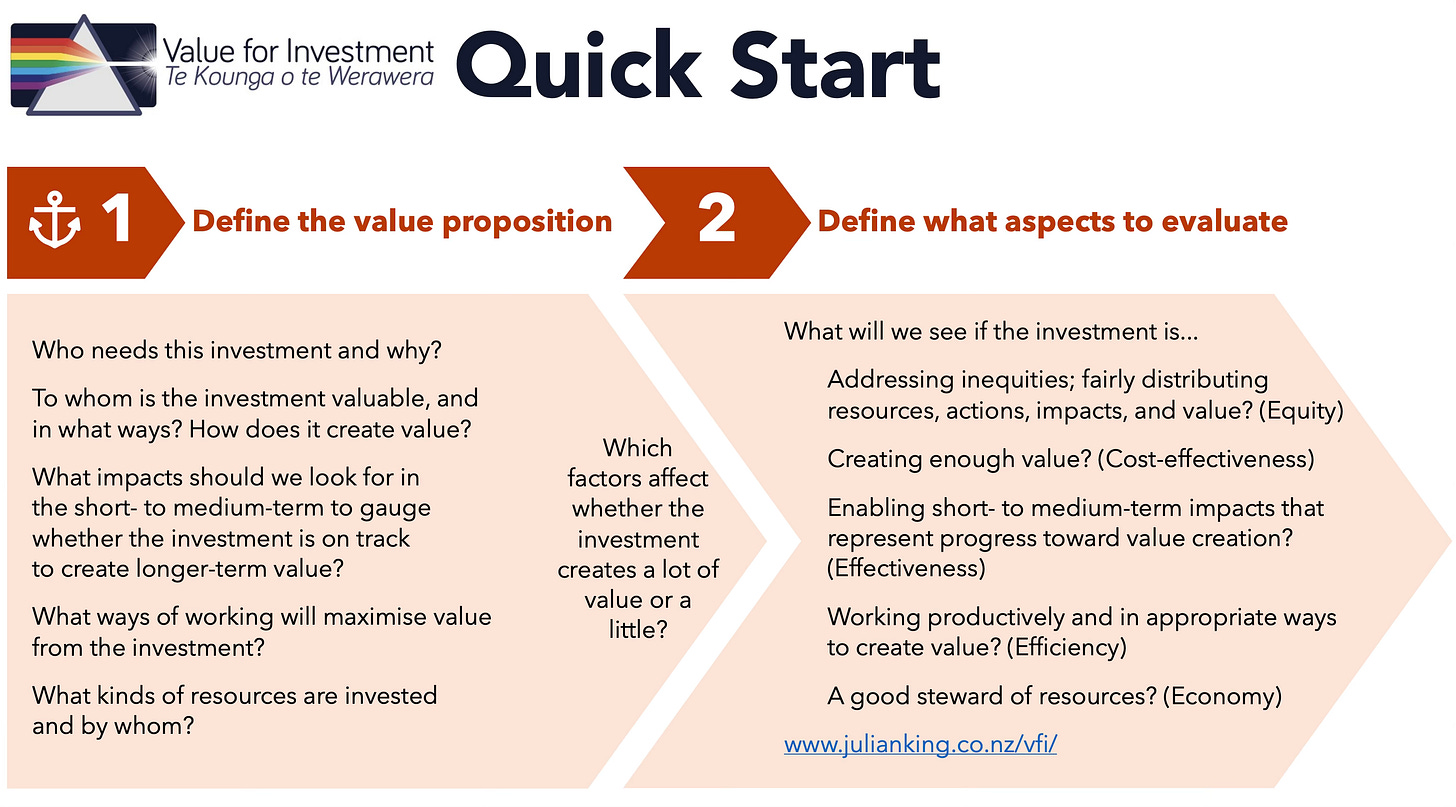

In essence, the VfI approach regards a policy or program as an investment in a value proposition, and evaluates how well that value proposition is being met. The first two steps in this process include defining:

the value proposition of the policy or program, and

what aspects of the value proposition to evaluate.

The QSG is summarised in the following diagram.

A downloadable template is available here for paid subscribers - but you don’t need the template to try out the QSG. Details below…

Why these two steps?

The objective of the QSG is to help scaffold a thinking process that results in a draft set of bespoke criteria for your program.

Criteria are the key aspects of the program that the evaluation will focus on. They should highlight the most important, observable features of good value for investment in a way that is specific and meaningful in your program and context.

The QSG uses the “5Es” as an initial checklist for scoping criteria. The problem is, if we focus on terms like economy and efficiency, there’s a risk of getting hung up on narrow definitions and indicators that don’t fit our context.

It’s more helpful to start by focusing on the program or policy without fixating on the Es. So the QSG says, ignore the Es, describe the value proposition by answering some straightforward questions, then come back to the Es and they’ll be E-zier to define…😁

QSG Step 1: Define the value proposition

The value proposition anchors a VfI evaluation. In some ways it might overlap with a theory of change (ToC), but it should be explicit about the resource investment and value creation.

The QSG outlines an easy process for scoping a value proposition: Simply jot down quick answers to the following questions:1

Who needs this investment and why? This question is about the specific needs (and whose needs) the investment is meant to address, including existing inequities and affected groups. This will guide you in defining Equity criteria.

To whom is the investment valuable, and in what ways? How does it create value? Describing which people and groups would value the investment, how it is valuable to them, and how the investment creates value for them, will help to define Cost-effectiveness criteria.

What impacts2 should we look for in the short- to medium-term to gauge whether the investment is on track to create longer-term value? Answering this will help identify Effectiveness criteria.

What ways of working will maximise value from the investment? This focuses on how organisational actions should be carried out to maximise productivity and create as much value as possible, helping you to define Efficiency criteria.

What kinds of resources are invested and by whom? This question encourages you to consider all types of resources invested, not just money but also relationships, knowledge, political capital, and other assets. Identifying these resources is the first step toward defining Economy criteria.

There’s one last question:

Which factors affect whether the investment creates a lot of value or a little? This question prompts you to examine your answers to the questions above, and prioritise the most important aspects to focus on. This prioritisation is useful when it comes to the next step, developing a short list of criteria…

QSG Step 2: Define criteria (what aspects of the value proposition to focus on)

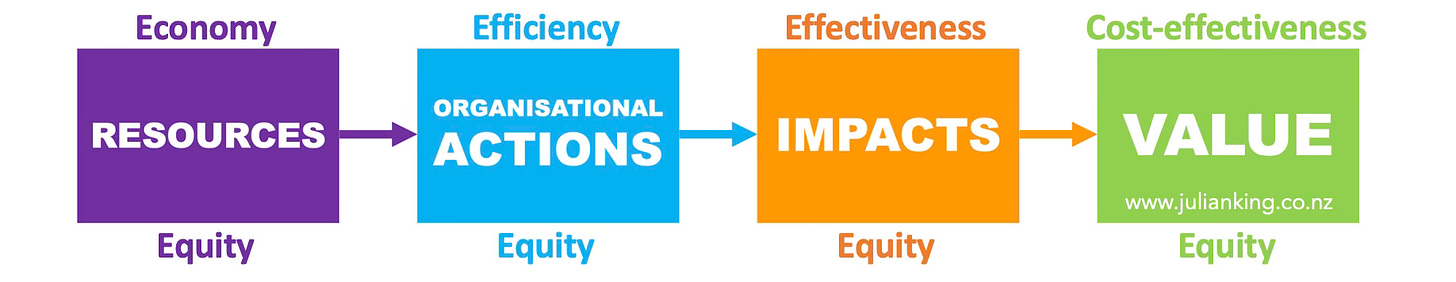

Criteria are the aspects of resource use and value creation that you will evaluate. The QSG uses the “5Es” as a checklist. The 5Es are a good starting point for scoping context-specific criteria because they address the whole value chain to consider how well resources are used to fuel appropriate actions that enable impacts that people value.

For each ‘E’, jot down a few bullet points that describe what aspects of the value proposition are critical to good resource use and value creation:

Equity defines what it would look like when the investment is addressing inequities, and fairly distributing resources, actions, impacts and value.

Cost-effectiveness defines what you would see when the investment is creating enough value to be considered worthwhile.

Effectiveness describes the short- to medium-term impacts that would tell you the investment is progressing toward meeting its value proposition.

Efficiency describes what you would see if the right actions are being carried out productively and in the right ways.

Economy describes what good stewardship of resources would look like.

Then what?

The QSG is designed to help you get rapid traction in the space of an hour or two, orienting you to the potential content of a value proposition and criteria, which are two key features of a VfI evaluation. You could take these first steps by yourself, with a colleague, client, or small group of stakeholders.

You could prompt an AI assistant to help - as long as you remain responsible for its inputs (e.g., it’s only as good as the prompts you give it, and don’t enter private or confidential information) and outputs (e.g., fact-check and sense-check everything; use apps like Perplexity that cite their sources to avoid plagiarism; write final copy in your own words). Here’s an example to illustrate.

The QSG is just to get you started. These first steps are all about scoping, and are not intended to result in a completed evaluation framework. Ultimately, the value proposition, criteria, and subsequent components of the evaluation framework should be co-designed with stakeholders to ensure they are meaningful in the context (this might include departing from the 5Es in small or large ways, as discussed here).

You should expect to go through several iterations of refining the value proposition and criteria, in a participatory process. For those next steps, it’s time to turn to the quick reference guide…

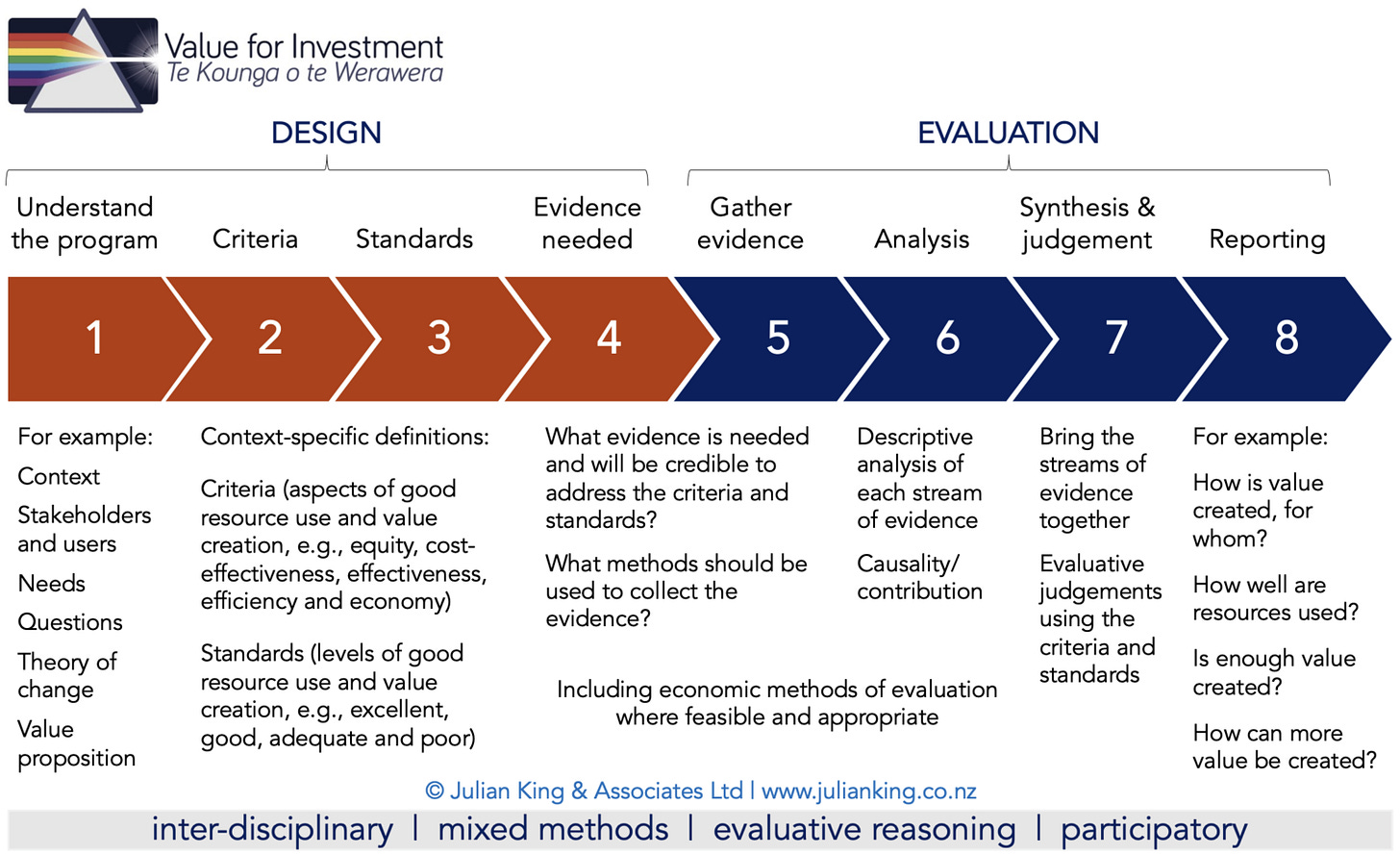

Quick reference guide

You may have seen this diagram before, outlining the full VfI process.

The QSG gives you a headstart toward defining the value proposition (just one part of step 1) and criteria (step 2). Next, it’s time to apply the full 4 principles and 8 steps, starting by developing a comprehensive understanding of the program (step 1), and collaborating with stakeholders to develop criteria (step 2), and standards (step 3). You may choose to present your draft value proposition and criteria to stakeholders as a conversation starter, or repeat the QSG process with the stakeholder group and a clean sheet of paper, and see what emerges.

For full guidance on the VfI approach, see:

King, J., Wate, D., Namukasa, E., Hurrell, A., Hansford, F., Ward, P., Faramarzifar, S. (2023). Assessing Value for Money: the Oxford Policy Management Approach. Second Edition. Oxford Policy Management Ltd.

King, J., Crocket, A., Field, A. (2023). Value for Investment: Application and Insights. Youth Primary Mental Health and Addictions Evaluation. Exemplar report for Te Whatu Ora – Health New Zealand. Dovetail Consulting Ltd.

Value for Investment resources page: www.julianking.co.nz/vfi/resources/

For extra guidance on developing criteria, see:

Downloadable QSG template for paid subscribers:

Feedback please!

This beta version of the QSG is intended for user testing and feedback. Please help me refine it by leaving a comment or sending a private message.

Acknowledgements

Thanks to Dr Kara Scally-Irvine for suggesting a QSG. Sheer brilliance! I love receiving ideas for VfI content. If you have a request, let me know!

And thanks again to Kara, and to Shiva Faramarzifar, for peer review of this article. Any errors or omissions are my responsibility.

The QSG contains a ‘short list’ of value proposition questions, intended to get you started. Later, you might want to consider additional questions such as: When do the different investments, actions, outcomes, and value occur? How long do they last? What magnitude are they expected to reach? What uncertanties and risks are involved? (Thanks to Stephen Adam for these helpful suggestions).

The term “Impact” gets used in different ways. Here I’m defining it broadly to include any difference in people, places or things that occurs as a consequence of the organisational actions. It spans outcomes (from immediate to long-term), intended or unintended, relative to a counterfactual and can be measured using any method, qualitative or quantitative, experimental or non-experimental (Gargani & King, 2023).